Being a pro retailer means more than knowing how to sell the right products to the right customers. You need to be an expert in inventory management as well—and you need to know how to marry sales and inventory to optimize your business.

That’s where your inventory turnover ratio comes in. Knowing this number can inform how you plan your purchasing, how you sell your goods and more.

In this guide, we’ll cover:

- What an inventory turnover ratio is

- The impact of inventory turnover on cash flow

- How to calculate your inventory turnover ratio

- Seasonality and inventory turnover

- What a good inventory ratio looks like

- How to increase your inventory turnover ratio

Let your inventory fly off the shelves with our guide

Today, retailers need to find creative ways of capturing the attention of those wandering into their store. Check out our guide to learn how to build relationships with window shoppers and create a lasting impression that sells.

What is inventory turnover ratio?

Inventory turnover ratio is a way of measuring how many times you’ve sold through and replaced your inventory in a given period—how many times it’s turned over, in other words.

Knowing your inventory turnover ratio gives you key insights into your business’ performance.

- A higher inventory turnover ratio often indicates a healthy business.

- A lower ratio can spell trouble.

Holding on to inventory for a long time is bad for business. If you’re not selling your stock, you’re not bringing in revenue to cover your operating costs, turn a profit and—crucially—buy new stock. As inventory becomes dusty, dead stock, it holds you back from investing in new products customers might be interested in. Ultimately, you stand to be left behind by your competitors.

Calculating your inventory turnover ratio means you can avoid getting blindsided by slow-moving stock. You can measure the health of your business, take a look at the impacts of new selling strategies, adjust your pricing and reassess your purchasing strategies as needed instead of waiting to react after it’s too late.

It is important to note that some industries will see more inventory turns than others simply by the nature of the products that are being sold. Apparel and perishable goods, for example, will turn faster than automobiles; fast fashion will turn faster than luxury fashion.

Understanding the impact of inventory management on cash flow

Effective inventory management directly impacts cash flow. When inventory is turned over quickly, products are being sold and not sitting on shelves, freeing up cash flow that can be reinvested into the business or used to cover other expenses.

Conversely, poor inventory management can tie up capital in excess stock, reducing cash availability for other operational needs. When capital is stuck in inventory, it isn’t available for growth opportunities or operational expenses. In extreme cases, it might lead to discounted sales to clear space, negatively impacting profit margins.

Proficient inventory management ensures that a business can maintain a balance between having enough stock to meet customer demand without overburdening its cash reserves, thereby safeguarding its financial stability and enabling growth opportunities.

And to do that, you need to keep an eye on your inventory turnover ratio.

How to calculate inventory turnover ratio

There are two ways to calculate inventory turnover ratio: by using your sales or your cost of goods sold (COGS).

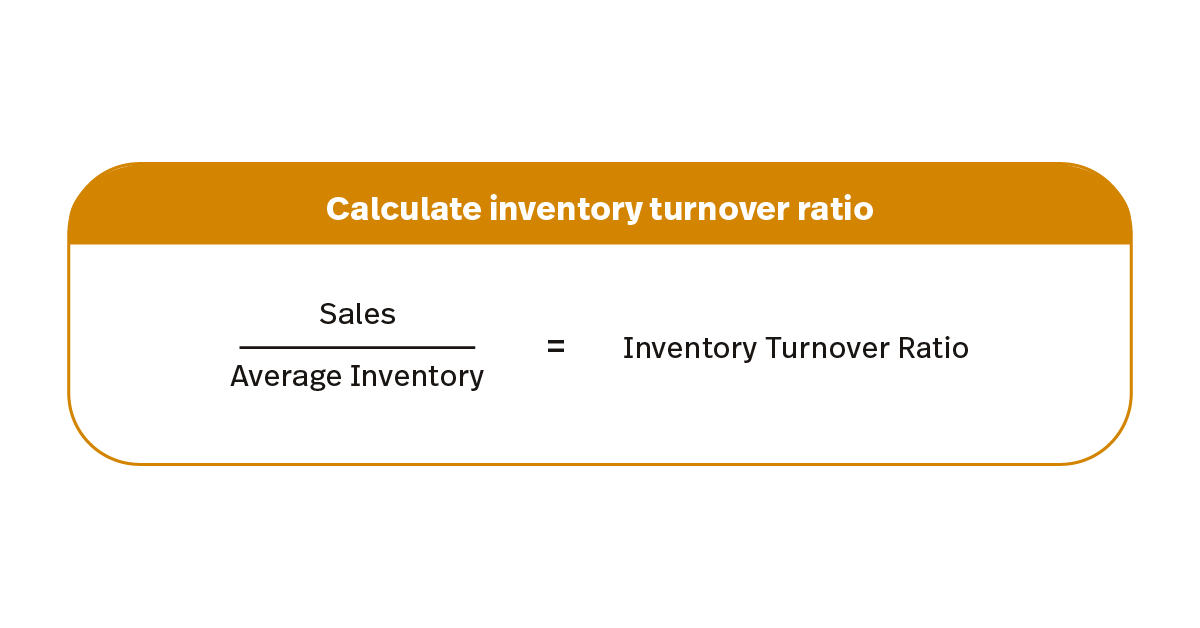

If you use your sales, the formula looks like Sales / Average Inventory = Inventory Turnover Ratio.

Using your cost of goods sold to calculate your inventory ratio can be more accurate. Sales figures include a markup, which may inflate your ratio and give you a higher number.

If you have your cost of goods sold on hand, you should use that number instead of sales.

If you use your cost of goods sold, the formula looks like this: Cost of Goods Sold / Average Inventory = Inventory Turnover Ratio

Either way, you’ll need to know your average inventory. You can calculate that by using this formula: (Beginning Inventory + Ending Inventory) / 2 = Average Inventory

Inventory turnover examples

Let’s look at an example to better understand. Say we wanted to calculate how quickly our apparel store was turning over its shoe inventory.

First, we need to know the cost of goods sold. We check our reports and see that the shoes sold in a year had a cost of $5000.

Next, we need to know the cost of our beginning and ending inventory during the year. Once we have that information, we add the costs together and divide them by 2 for a total of $1300.

With those numbers on hand, we look at our inventory turnover ratio formula.

5000 / 1300 = 3.8

We turned over our shoe inventory 3.8 times last year.

Calculating days sales of inventory (DSI)

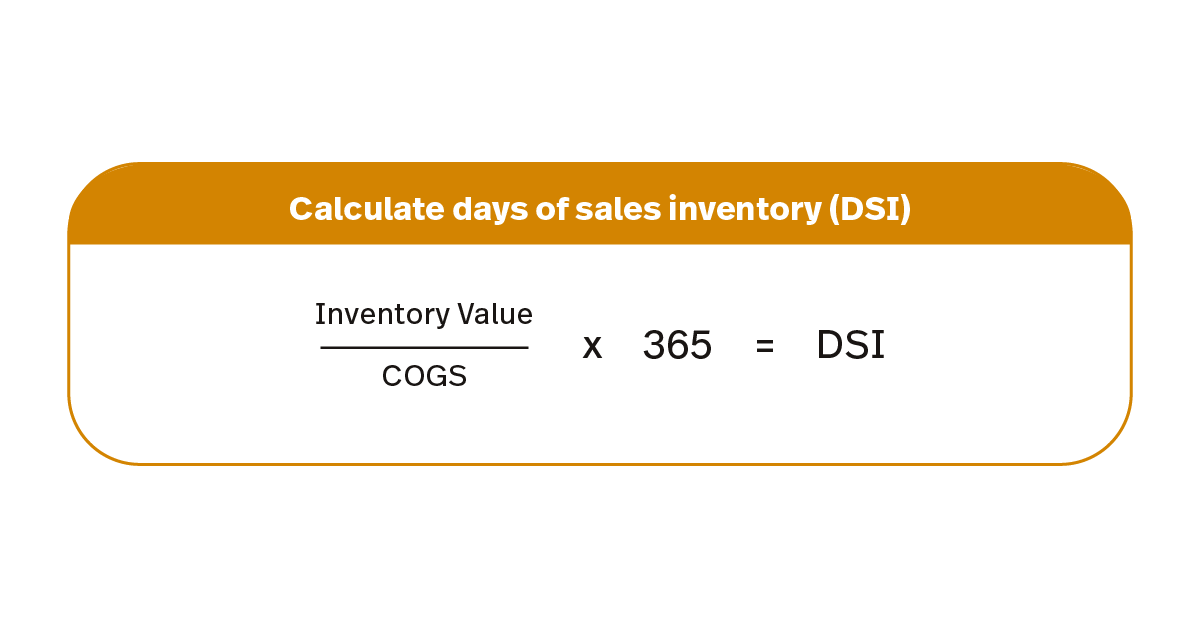

Another formula you can add to your arsenal to gauge inventory turnover is the Days Sales of Inventory (DSI). Sometimes referred to as Days Inventory Outstanding (DIO) or Days In Inventory (DII), it helps you measure the average length of time your cash is tied up in inventory and also puts inventory turnover into daily context.

To find your measurement, you’re going to take your year-end inventory value, divide by your COGS, and then multiply by 365 for the number of days in a year: (Inventory Value / COGS) x 365 = DSI.

What is a good inventory turnover ratio?

A higher inventory turnover ratio is typically better. A high ratio generally tells you that:

- You’re purchasing enough stock. Your purchasing budget is set right and your inventory forecasting is accurate. You’re purchasing enough to have full shelves to meet demand, but not so much that you’re overstocked.

- Your employees are effectively selling your inventory. Your customers are responding well to your sales tactics and your employees are providing good service.

However, it can also mean you’re not putting in big enough orders when you restock. If your inventory turnover ratio is exceptionally high, your customers may be frequently running into empty shelves as they wait for you to reorder goods. Since this can drive customers away, it’s important to keep an eye on how often you end up totally out of stock.

If you have a low inventory turnover ratio, you could be dealing with one or more of the following problems:

- You’ve been overstocking. You’re purchasing too many units in your orders, and customers aren’t responding with the same demand.

- Your inventory isn’t resonating with customers. Whatever you’ve got on the shelves—even if you don’t feel like you’ve overstocked—isn’t what your customers want from you. They may be going to competitors for their needs instead.

- Your sales tactics aren’t strong enough. You could have the most cutting edge, desired products in stock… but if your customer experience is no good, you risk losing sales.

Comparing your inventory turnover by industry

What exactly is a low or high ratio varies by industry. Fashion retailers average between 4 to 6 turns, for example, while car dealerships average a lower 2 to 3—but car components can have turnovers as high as 40. Once you have your ratio, research your industry’s average number of turns to compare yourself to the competition.

The impact of seasonality on inventory turnover

Your inventory turnover ratio will rarely be static. It’s more likely to rise and fall throughout the year.

For example, a fashion retailer experiences high turnover during the change of seasons when demand for new clothing lines peaks. Conversely, during off-season periods, inventory turnover may slow, leading to potential overstock and markdowns, negatively affecting profitability.

Similarly, a garden supply store sees a spike in inventory turnover during spring and summer, aligning with gardening season. During winter, sales slow, and managing seasonal stock becomes crucial to avoid overstocking on perishable goods or seasonal items.

As long as these peaks and valleys are within expected fast and slow periods for your niche, they’re not worrying in and of themselves. But that doesn’t mean you can’t improve your off-season inventory turnover ratio.

Optimize seasonality by adopting strategic inventory management practices:

- Forecast demand based on historical sales data to plan appropriate stock levels. There’s no need to carry busy-season levels during slow periods—you’ll just end up with dusty stock.

- Diversify your product range to include items that sell year-round, like socks or batteries, to stabilize turnover rates.

- Implement promotional strategies during peak seasons to clear out remaining stock before you hit the off-season, freeing up space and capital for upcoming seasonal inventory.

How to increase inventory turnover for your retail business

If your inventory turnover ratio is lower than your industry’s average, you’ll need to take action.

Adjust your purchasing plans

Get your stock in order with accurate inventory forecasting.

Compare the turnover ratio of various categories to their sales figures and see where you could start ordering less. If sales of a particular product or category have started to drop off, you could combine ordering less of them with bringing in new products that are more in line with your best sellers.

Review your pricing strategies

Pricing can drive customers away, even if the quality of the products and their experiences land. If your sales aren’t strong, you could consider implementing some of the following pricing strategies:

- Bulk pricing: this is where customers save money based on how many units they buy (1 for $3, 2 for $5, 3 for $7, etc).

- Seasonal discounts: if your retail business has a seasonal edge—apparel seasons, for example—start discounting incrementally earlier in the season. Instead of having blowout end of season sales where you try to move a lot of inventory at steep discounts, start with much smaller discounts about halfway through the season and increase the discount from there.

- Bundle pricing: like bulk pricing, customers get more while paying less. Here, though, you bundle different items together to move stock. It’s much like upselling, but with some of the sales legwork already done if you make the product bundles yourself.

Try new sales tactics

You can improve weak sales by making shopping with you exciting. Beyond just selling products, your employees can make your store a memorable brand that customers want to keep coming back to.

Consider taking personal shopper appointments. You don’t need to be a luxury goods retailer to give your customers a white-glove experience. Appointment shopping can be done during regular hours or after hours, in-person or online through video calls. It gives customers a more intimate shopping experience, which provides your employees with more chances for upsells.

Leveraging technology to improve inventory turnover

Retailers can significantly enhance inventory turnover in both peak and off-seasons by embracing technology, particularly through advanced point of sale systems like Lightspeed.

These systems do more than process sales; they collect valuable sales data that can inform inventory decisions. For instance, by analyzing sales trends, a retailer can identify which products are selling quickly and which are not, enabling them to adjust their inventory levels accordingly. This means ordering more of the high-demand items and reducing stock levels of slow-moving products, thus optimizing inventory to meet customer demand without overstocking.

That’s exactly why Limbo Jewelry uses Lightspeed’s reports to monitor inventory. They’re able to communicate their findings with vendors and optimize ordering up the supply chain. “They say we’re the most organized store they work with because we’re able to pinpoint exactly what’s selling, exactly what’s not selling,” says Limbo’s Anne Rutt-Enriquez.

POS reporting can also help retailers forecast future sales based on historical data, seasonal trends and consumer behavior patterns. This predictive insight allows for more accurate ordering, minimizing the risk of excess inventory and ensuring shelves are stocked with items likely to sell.

Implementing automated ordering systems further streamlines the replenishment process, reducing manual errors and saving time.

Healthy business from higher turns

Your inventory turnover ratio is an important KPI that you should be keeping an eye on. Think of it as the canary in your retail coal mine—if it starts to drop, you know there’s crucial work to be done optimizing your purchasing and adjusting your sales tactics.

Managing retail inventory? That’s what we do best. If you want to chat about how Lightspeed’s built-in reports and tools could help you become an inventory management and forecasting wizard, get in touch.

Frequently asked questions about inventory turnover

What is a good inventory turnover ratio?

A good inventory turnover ratio differs by industry. For most retailers, a good turnover ration will be between 4 to 10.

How do you calculate inventory turnover?

You can calculate inventory turnover by dividing the cost of goods sold (COGS) by the average inventory for a specific period.

What is a low inventory turnover ratio?

A low inventory turnover ratio, generally below 4, suggests that a company may have overstocked inventory or weak sales, indicating inefficiencies in managing stock.

What is the formula for the turnover ratio?

The formula for inventory turnover ratio is:

Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory.

Is high inventory turnover good?

Yes, a high inventory turnover indicates efficient inventory management and strong sales, but exceedingly high turnover may lead to stock shortages and lost sales.

How do you fix low inventory turnover ratio?

To improve a low inventory turnover ratio, consider reducing stock levels, increasing sales through marketing and promotions or diversifying the product range to stimulate demand.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.