Payment processing is a key component of any business. If you’re not already processing credit card transactions, now is a great time to start. Before you do, though, there are some key things you need to know as a business owner, which you’ll learn in this article.

Despite all the new payment methods that have cropped up over the past few years, credit cards are here to stay. In the US, the number of credit cards used has been rising for years and will continue to do so, with nearly 28 million new cards expected to be issued between 2024 and 2028. That reinforces the fact that in today’s fast-paced business landscape, the ability to accept credit card transactions has become more than just a convenience–it’s a necessity.

For medium-sized businesses in particular, accepting credit cards is important as you navigate the challenging terrain between small businesses and corporate giants. Every financial decision can significantly impact your growth trajectory. Offering the convenience of credit card payments can lead to increased sales, improved cash flow and higher customer retention rates. In a time when consumers increasingly rely on cards for transactions, not providing this payment option can put medium-sized businesses at a significant disadvantage.

As a payment processor ourselves, we know how to set up payment processing and what to look out for when you’re on the hunt for a provider. That’s why we’ve put together this handy guide to help you get transactional with your customers that want to pay with a credit card or with their phone.

What is credit card transaction processing?

Credit card transaction processing is the electronic system that facilitates the secure and seamless transfer of funds from a customer’s credit or debit card to a merchant’s account, enabling businesses to accept payments for products or services.

It involves multiple steps, including card authorization, payment verification and settlement, ensuring that transactions are processed efficiently and securely while following industry standards and regulations.

In this blog, you’ll learn about:

- Key players in credit card transactions

- How credit card processing works

- Credit card processing fees and pricing models

- Security and compliance best practices

- How to choose the right payment processors

- Real-world examples in action

With Lightspeed, your payment processing is embedded with your POS system. Talk to one of our retail experts today and wave goodbye to complicated third-party agreements once and for all.Looking for a complete payment processing solution?

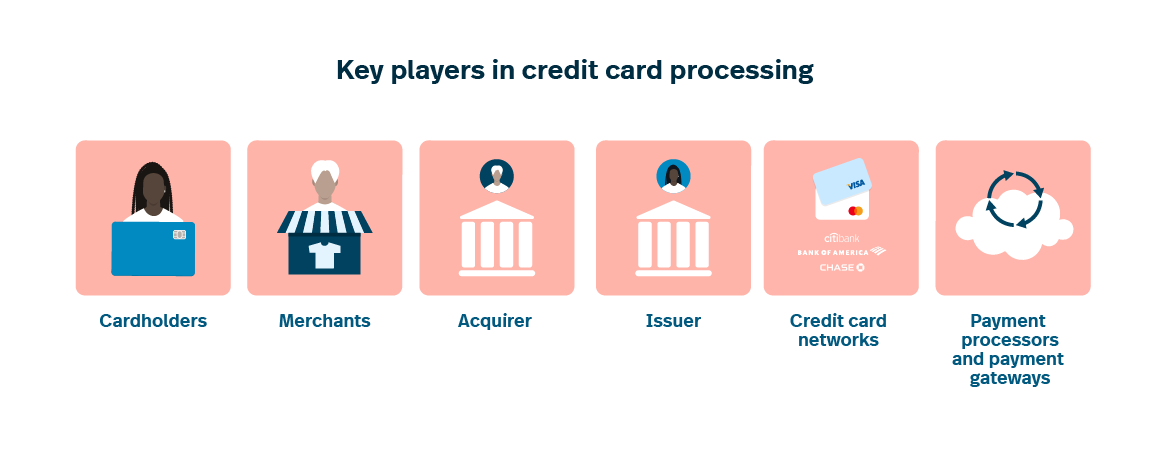

Key players in credit card processing

Before we talk about how credit card transactions are processed, you need to know the basics of some of the terms we’ll be using throughout this guide.

1. Cardholders

The cardholder is an individual who uses a credit or debit card to make purchases. They initiate a credit card transaction by presenting their card as a payment method at a merchant’s point of sale in-store or online.

2. Merchants

A merchant is the business or entity that sells products or services and accepts credit card payments from customers. Merchants use payment processing systems to facilitate these transactions, ensuring a convenient payment experience for their customers.

3. Acquirer

The merchant’s bank, also known as the acquirer, is a financial institution responsible for establishing and maintaining the merchant’s account. They work in tandem with the merchant to process credit card payments, verify transactions, and ensure that funds are promptly deposited into the merchant’s account.

4. Issuer

The cardholder’s bank, referred to as the issuer, is the financial institution that issued the credit or debit card to the cardholder. The issuer is responsible for approving or declining transactions, managing the cardholder’s account, and handling disputes or fraud claims.

5. Credit card networks

Credit card networks, such as Visa, MasterCard, American Express and Discover, act as intermediaries between issuers, acquirers and merchants. They facilitate communication and standardize processes. This is to ensure the seamless authorization, clearing and settlement of transactions across a global network of participating banks and merchants.

6. Payment processors and payment gateways

These providers play a crucial role in facilitating credit card transactions. Payment processors handle the technical aspects of transaction processing, including authorization and settlement. Payment gateways, on the other hand, securely transmit transaction data between merchants, processors and card networks, and act as a sort of “bridge” between online businesses and the broader payment ecosystem.

How credit card processing works

Now that we’ve covered important terms, let’s dive into how credit card processing works for both online and offline transactions.

Breaking down credit card transactions

A credit card transaction involves several steps to ensure a smooth and secure exchange of funds.

Step 1: The customer initiates a purchase by presenting their card at the merchant’s point of sale (POS) terminal or entering their card details online. At POS, transaction details, which include the card number, purchase amount and business information, are captured.

Step 2: After that, the information is transmitted securely to the payment processor or gateway. There it is encrypted to protect sensitive data from theft or other cybersecurity risks, and the processor forwards the transaction request to the issuer for authorization. The issuer assesses the legitimacy of the transaction. They ensure the cardholder has available funds to make the purchase and look for signs of fraud.

Step 3: Once the transaction is approved, the issuer sends an authorization code (usually five or six numbers) back to the merchant’s POS system or website to confirm the sale. The merchant completes the sale, and the transaction amount is reserved on the cardholder’s account, temporarily reducing their available credit.

Step 4: Last, the authorized transactions are stored in a batch for later settlement, and the funds are transferred from the cardholder’s bank to the acquirer as part of this clearing and settlement process, usually within a few business days.

Role of POS systems in credit card processing

POS systems are the central hub for credit card transactions in physical retail environments. They facilitate the capture of transaction data, including the cardholder’s card information, transaction amount and merchant details. POS systems encrypt this data before sending it to payment processors or gateways, ensuring that sensitive information remains secure throughout the process.

POS systems also play a pivotal role in enhancing the customer experience by providing quick and convenient payment options, including chip-and-PIN, contactless, or mobile wallet payments. Additionally, they help merchants manage inventory, generate sales reports and streamline accounting, making them invaluable tools for businesses of all sizes.

Further, as a business owner, you can streamline your operations when your POS and payment processor work together as a single system from one provider. Centralizing POS and payments software ensures seamless communication between systems. It also enables business owners to manage transactions, track sales and reconcile amounts within a single multifunctional ecosystem.

The importance of authorization

Authorization is a critical step in credit card processing because it determines whether a transaction can proceed. It serves as a fraud prevention mechanism, ensuring that the cardholder has sufficient funds to cover the purchase. When a transaction is authorized, it means the issuer has given its approval, making the sale legally binding.

Authorization is essential not only for security but also for the customer’s peace of mind. It prevents overspending, reduces the risk of fraud, and protects cardholders from unauthorized transactions. Merchants must receive authorization before completing a sale to guarantee that they will receive payment and avoid chargebacks or disputes.

Batching and transaction submission

Once a day’s worth of authorized transactions has accumulated, merchants typically batch them together for submission. Batching involves sending all authorized transactions as a single batch to the payment processor or acquirer for settlement. This process simplifies accounting and reconciliation for the merchant.

Batches are usually submitted at the end of the business day. However, some businesses may submit multiple batches throughout the day for real-time or near-real-time settlement. Then, the payment processor then processes the batch, deducts any applicable fees, and transfers the funds from the cardholder’s bank to the merchant’s bank.

Batching and transaction submission ensure that the merchant receives the funds owed for all authorized transactions efficiently, streamlining the financial aspect of credit card processing for businesses.

Credit card processing pricing models and fees

Choosing your payment processor also means choosing from a myriad of different pricing models. Understanding what each of them entails and the types of fees you’ll be charged will give you a clearer idea of what your bill will look like month-to-month.

For a quick summary, this table covers the differences between the three models we’ll discuss.

| Pricing model | Description | Pros | Cons |

| Flat Rate | Charges a fixed percentage fee per transaction, regardless of card type or transaction amount. | Simple and predictable pricing | May not be cost-effective for high-value transactions or certain card types. |

| Interchange Plus | Combines a fixed markup with interchange fees set by card networks. Offers transparency, as you see actual interchange costs. | Transparent, cost-effective for various transaction types | Complexity due to varying interchange fees. Higher initial setup and monthly fees. |

| Tiered Pricing | Categorizes transactions into tiers and charges different rates for each tier. Typically includes qualified, mid-qualified, and non-qualified tiers. | Simplicity for businesses with consistent transaction patterns | Lack of transparency, as specific interchange costs are hidden. Can lead to higher costs for non-qualified transactions. |

Flat rate

When you use a flat rate processor, all of your transactions fall under one flat rate. This rate includes both the interchange or wholesale rate plus the processor’s markup. With this type of pricing, you can be at ease knowing what your processing expenses will be from month-to-month.

For instance, Lightspeed Payments uses a predictable, one-rate pricing model—you know that every time someone uses their credit card to make a payment, you’ll pay a fee of 2.6% + $0.10 for card-present (CP) transactions, or 2.9% + $0.30 for card-not-present (CNP) transactions.

Interchange plus

Payment processors that use an Interchange Plus pricing model do things a little differently. Credit card companies like Visa and Mastercard charge merchant accounts and financial service providers and those fees are then passed on to retailers who sign up with the payment processor. Your month-to-month bill is unpredictable, as your Interchange fees can change depending on the cards used to make purchases in your store.

Typically, payment processors who offer Interchange Plus pricing have a fixed markup added to your fee. Be careful when selecting your payment processor—you will be paying the unpredictable Interchange Plus fees as well as their advertised fixed markup.

Tiered pricing

Tiered pricing is another model you might see. With tiered payment processing, all transactions you take are sorted into one of three tiers: either qualified, mid-qualified or non-qualified. Typically, merchants sign up for tiered pricing expecting most of their transactions to be processed with the favorable qualified rate. In reality, most of their transactions are pushed to the much more expensive mid- and non-qualified tiers. Rarely are merchants told why a card is processed on the tier it is. This model usually isn’t recommended as it lacks transparency, and makes for unpredictable pricing.

Read our article to learn more about these payment processing pricing models.

Other fees

It’s essential for medium-sized business owners to thoroughly review and understand any other fees from their processor. This way, you can ensure transparency and minimize unexpected costs.

Those fees include:

- Payment gateway fees: You may encounter this if you accept online payments. This fee covers the use of the payment gateway.

- Monthly statement fee: Some processors may charge a monthly statement fee to cover the cost of providing transaction statements to the merchant. This fee is typically a fixed amount.

- Chargeback fee: When a customer initiates a chargeback dispute over a purchase, the merchant may incur a chargeback fee. This fee covers the administrative costs associated with handling the dispute.

- Early termination fee: Some processors have contracts with early termination fees if a merchant ends the agreement before the contract term expires. These fees can be quite substantial, and you can avoid them by thoroughly reviewing the terms of the agreement before signing anything.

- Equipment fee: If a merchant leases or rents payment processing equipment, such as card terminals, they may be charged a monthly fee to use the equipment.

To minimize costs associated with payment processing, carefully review your specific business needs, fee structures, pricing models and contract terms. As a growing business, you have to ensure that you won’t be dealing with excessive fees that eat into your profit margins. Plus, fees, monthly minimums and chargebacks can all affect your cash flow–so budget accordingly.

Depending on your business needs, the pricing model that works best for you is one that aligns with your cash flow needs. If your business is highly seasonal, for instance, consider an interchange plus model because of the flexibility it offers.

Overall, thoroughly researching credit card processors will give you the confidence you need to choose the one that’s best for your business.

Importance of PCI compliance and security standards

With processing power, comes security responsibilities. If you want to start taking credit cards, you also have to ensure you stay compliant with security measures to protect customer data. The PCI SSC—Payment Card Industry Security Standard Council—outlines minimum requirements for PCI compliance.

All merchants who accept credit cards as a form of payment or who transmits or stores cardholder data must comply with PCI SSC standards. For businesses with multiple locations, PCI compliance has to be validated for each one.

Getting up to speed on PCI requirements is important because you could be in for some serious repercussions if you don’t. Those include hefty fines, legal liabilities and reputational damage. For businesses aiming for sustainable growth and long-term success, complying with PCI standards is an essential investment in security, reputation and operational resilience.

However, some payment processors handle the fiddly details for you. Lightspeed, for example, is a level 1 provider that includes PCI compliance for all our merchants right out of the box.

Our article on PCI compliance will give you all the information you need.

Essential security measures and protocols

It’s important for you to implement comprehensive security measures to maintain customer trust and protect their sensitive data. Here, we’ve listed just a few security protocols, which are also covered by the PCI DSS standards.

- Data encryption: Encrypt sensitive data both in transit and at rest. Use strong encryption strategies to secure data stored on servers, databases and in backups.

- Tokenization: Implement tokenization to replace sensitive cardholder data with unique tokens. This lowers the risk associated with storing actual card number.

- Firewalls: Put firewalls in place to monitor network traffic and block potential threats or unauthorized attempts to access your system

- Software updates: Keep all software, including operating systems, applications, and security software, up to date with the latest security patches and updates.

- Employee training and awareness: Educate employees about security best practices, cybersecurity threats, and the importance of protecting sensitive information. Conduct regular security awareness training.

- Use the right hardware: Make sure you’re using hardware (such as credit card terminals) that is compatible with your payment processing system. Out-of-date technology puts customer information at risk.

Further, you should implement a strategy for dealing with chargebacks. Handling these effectively is essential for reducing the risk of financial losses, as well as maintaining strong customer relationships.

The evidence you have to collect if you’re disputing the validity of the claim includes transaction records, sales receipts or customer communications. A good payment processor will help you gather the necessary information and documents. They’ll also assist you in assessing the chargeback’s validity and even handle the entire process on your behalf.

For instance, Lightspeed merchants get free chargeback assistance when they use Lightspeed Payments.

How to choose the right credit card processor

Your point of sale system powers your entire business, so picking the right system should be your top priority.

Depending on the POS provider, there may be an in-house embedded payment processing solution available to you. An embedded solution is ideal and will save you lots of time every day. In the United States, Lightspeed Retail POS users can process their payments with Lightspeed Payments.

These solutions are ideal because they allow you to run your operations, and all your locations, from one centralized platform. Further, you can view your sales, inventory and customer information in a single place, streamlining your operations and making it easier to scale.

If you’re not planning to use a unified POS and payment processing solution, you’ll need to also sign up for a merchant account at this point. This can be done at any bank.

Once you have your POS selected, you need a payment processor to start selling. If your chosen payment processor is embedded directly into your POS system, purchase the required hardware through your processor of choice. That way, you’ll know it’s compatible with your software.

If you’re not going with an integrated payment processor, you’ll need to shop around for the best offering for your business. To help you find a payment processor, take a look at our article on the seven questions you should ask during your search.

Additionally, be careful not to get caught in a plan with a lot of hidden fees. For tips on how to get the best rate from your payment processor, see our guide on point of sale systems.

Factors to consider when choosing a payment processor

- Fees: Compare pricing models, including transaction fees, monthly charges, and any potential hidden costs, to find the most cost-effective solution.

- Scalability: Choose a processor that can scale with your business as it grows in size and complexity. A unified solution typically works best for this.

- Security: Prioritize a processor with robust security measures. They should stay up-to-date on PCI and industry standards on your behalf.

- Payment methods: In a time of super-high customer expectations and plenty of options, stay competitive by choosing a processor that supports various payment methods. This includes credit cards, digital wallets, mobile payments and online transactions.

- Customer support: What’s important to you when it comes to support? Do you want to be able to reach someone 24/7, or are you okay with support being available just 5 days a week? Evaluate the quality and responsiveness of customer support to address any issues or concerns promptly.

- Reputation: Research the processor’s reputation, read reviews, and seek recommendations from your industry peers to gauge their recommendations and advice.

- Contracts: Review contract terms, including length and termination fees. This is to avoid long-term commitments that may not suit your business’s needs.

Case studies and real-world examples

We’ve talked about the ins and outs of credit card processing and how to choose the best provider for your business. Given that, let’s take a look at what a unified payment processing and POS solution can do for your business. We’ll take a look at Lightspeed customers as examples.

The Brande Group

For this Montreal retailer, the retail management system they used before was holding them back. Their business model is fast-paced: they frequently purchase inventory for their store to keep up with the latest fashion trends. They then sell the inventory at an affordable price.

“It was an old system, a more expensive system that needed a team of people in your headquarters to make sure it worked well with everything you need to do to keep the ERP up to date,” says the company’s retail buyer, Guillaume de Laplante.

They decided to go for Lightspeed’s unified POS and Payments solution. In doing so, they’ve since reduced errors and saved time. “I know it sounds archaic, but not too long ago we needed to print two receipts to complete the sale. So there were human errors. Now [with Lightspeed Payments] it’s embedded. … There’s one transaction and one receipt.”

By using an embedded payment processing system, The Brande Group is better equipped to process credit card transactions.

City Bird

Detroit-based retailer City Bird is a curated gift shop, focusing on products that celebrate its hometown. They’ve used Lightspeed for over a decade.

Due to the fact that they run more than one location as well as an online store, co-founders Emily and Andy Linn needed a way to connect all these revenue streams. With Lightspeed Retail and Lightspeed Payments, they manage their extensive inventory and can sell their products from just one platform.

Lightspeed Retail POS, powered by Lightspeed Payments, allows the owners of City Bird to manage all of their inventory from one platform, and gives them the freedom to sell anywhere and innovate. They also tout Lightspeed’s chargeback assistance: “With Lightspeed Payments specifically, support has been outstanding. Lightspeed’s assistance with chargebacks is something completely new for me,” Andy says.

Altogether, they’ve saved 0.5% on every transaction since switching to Lightspeed Payments. Consider City Bird as a real-life example of how a streamlined payment processing could benefit your business.

Choose the right payments solution for you

Now that you know how to start accepting credit card transactions, what to look for in a provider and how a centralized POS and Payments solution could support your growth goals, it’s time to weigh your needs. Nowadays, the technological solutions you use to operate your business can dictate the way you scale and how you innovate.

Admittedly, we’re a little biased here, but with reason. Lightspeed Payments is a completely embedded payment processing solution that our merchants love because it’s simple to get started, the fees are predictable and our customer support is always there when they need us.

Obviously, the choice is yours, but if you want to learn more about Lightspeed Payments and how it fits into your business, call our team of retail experts today and let’s talk.

Editor’s note: Nothing in this blog post should be construed as advice of any kind. Any legal, financial or tax-related content is provided for informational purposes only and is not a substitute for obtaining advice from a qualified legal or accounting professional. Where available, we’ve included primary sources. While we work hard to publish accurate content, we cannot be held responsible for any actions or omissions based on that content. Lightspeed does not undertake to complete further verifications or keep this blog post updated over time.

FAQ

1. What is a credit card transaction?

A credit card transaction is a financial exchange in which a customer uses a credit card to make a purchase or payment for goods or services.

2. How are credit card transactions processed?

Credit card transactions are processed electronically through a series of steps that include authorization, verification and settlement. When a customer initiates a transaction, the card details are captured, encrypted and sent to the payment processor. The processor communicates with the cardholder’s bank to verify the transaction’s validity. Once approved, it facilitates the transfer of funds to the merchant’s account.

3. What are the types of credit transactions?

A credit transaction type refers to the category or classification of a credit card transaction based on its purpose. Common credit transaction types include purchases, balance transfers, and payments.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.