Pricing is one of the most important activities for retailers.

But it can often feel like guesswork.

That’s because pricing is tied up in much more than a number, for your customers. It can touch on ideas like value, status, gratification—and (don’t laugh), even joy.

Everybody loves a bargain. And people can have some very emotional reasons and reactions to what they buy. It’s why there is an entire culture around unboxing products and the satisfaction that can bring.

As a retailer, your prices may give people a whole range of emotions about your store, your product range and your company’s brand.

In this article, we’re going to dive a little deeper into retail pricing, with the help of several experts. You’ll learn:

- How to price a product for retail

- 15 retail pricing tactics

- How to lower your prices the right way

- Choosing a retail pricing strategy

The psychology of price

Get in-depth advice you can apply to your store today–the ultimate tips to maximize your revenues.

How to price a product for retail

“Pricing is one of the main levers that can be pulled to control profit margins, but on the other hand price levels that are too high will alienate customers and drive them to the competition,” says Josh Pollack, a pricing expert at Parker Avery Group, a retail and consumer goods consultancy.

One way to think about pricing is to think about whether a given product is something that is a repeat purchase or a one-time purchase, explains CPA and ecommerce consultant Abir Syed of UpCounting.

“If something might only be purchased once, like a pool table, you’ll need to make back your money after taking into consideration the customer acquisition cost. But if something is a repeat purchase—like a protein bar—then you can price lower knowing that you’ll make back your money off the customer’s lifetime value,” says Abir.

Pricing traffic drivers and margin enhancers

Here’s where it becomes more strategic.

“Some items can be classified as ‘traffic drivers’,” says Josh, of Parker Avery Group. “Prices and promotions on these items can be deployed to increase unit sales and customer traffic. Other items are ‘margin enhancers’. Customers are much less aware of the relative prices of these items, so those prices can be [moved] to improve profitability. Retailers can establish a range of pricing strategies to apply to different product categories.”

There are a few main approaches to pricing. You can:

- Price based on your costs. This means having an accurate understanding of the cost of your product, and marking it up to be profitable (we’ll talk more about markups later). To do that well you have to have a good understanding of your sales and marketing costs, overhead, and the volume of stock you can realistically sell.

- Price based on your competition. Research your competitors in the market and look into the similarities in your product ranges. Are you much more expensive than others who sell similar products, or are you losing margin by discounting too heavily?

- Price a product range. This is where common practices like loss leaders come in. This is when you sell a given product at a lower price, to attract customers to purchase higher-priced products elsewhere in the range.

A quick word about wholesale vs retail pricing

But hey, not every retail business is selling directly to consumers—some are selling to other retailers. With wholesale pricing you mostly need to factor in a different set of overheads, suggests Abir Syed of UpCounting. Your sales and marketing cost structure will be very different from selling retail, and each customer will buy much larger volumes, notes Abir.

“Another significant difference would be to your warehousing and distribution set up when doing fewer large shipments, as opposed to many small ones direct to consumers. If you have brick and mortar locations, then that can bring in a whole other overhead consideration,” he said.

15 retail pricing strategies with examples

Let’s run through some of the different retail pricing models.

1. Manufacturer suggested retail price (MRSP)

“Manufacturer suggested resale price (MRSP) is the price a product maker suggests vendors sell the product for,” according to Meaghan Brophy, a retail and ecommerce analyst at FitSmallBusiness.

“Though according to antitrust law, manufacturers cannot dictate the prices at every stage of the resell process, they can choose what vendors they distribute products too. It is a common practice, particularly for manufactures that sell to companies that sell on Amazon, to only work with retailers that agree to abide by the MSRP.”

2. Markup pricing

Let’s not forget markup pricing, a standard retail pricing strategy where you sell products for higher than their wholesale price. Customers are willing to pay this markup because of the services retail businesses provide them, from managing the sourcing from wholesale businesses to the customer service in store.

While keystone pricing has been conventional in the past—see below for more details on that—today markups are often much lower (though they’re occasionally higher!).

“Amazon and its sellers are notorious for driving down prices and retail margins. In order to stay competitive, retailers sometimes price a product with margins smaller than 100%. It can make sense for retailers to compete in this way if they are selling a high-volume of products or trying to clear through seasonal or perishable items,” explains Meaghan.

“However, there are also scenarios where a retailer can price a product above a 100% markup. This is common with private labels and custom products, cosmetics, jewelry, electronics and alcohol, for example.”

3. Keystone pricing

This usually applies to prices set at double the wholesale price. “The predominant pricing strategy for retailers is to do a 100% markup,” says Meaghan. “That means if they purchase a good from the supplier or manufacturer for $20 they sell it to shoppers for $40.”

This used to be the convention for pricing clothing, but is less common nowadays.

4. Price skimming (or skim pricing)

With price skimming, you set prices for a new product very high. The higher price has a huge margin, offsetting lower sales from customers that can’t afford the product.

Typically, as competitors enter the market, the price is dropped. These price drops help your product retain a competitive edge, either because of the perceived value of a discount or because your product is now more affordable than the competitor. In theory, the increased sales volume makes up for the lower margins.

However, if you manage to enter the market early enough, you may be able to hold onto a higher price point that communicates value to the loyal customers you’ve built up.

Apple is a master at skim pricing, and they rarely rely on dropping prices to keep their competitive edge. The higher prices instead communicate high value to customers; as Ishika Agarwal of The St Andrews Economist points out, “In 2019, Apple launched the iPhone 11, priced at $649, while the iPhone 11 Pro was sold at $999 and the iPhone 11 Pro Max at $1099. Here, the iPhone 11 Pro acted as the decoy since there is not much difference in the 11 Pro and 11 Pro Max prices. So, a consumer would get tricked into comparing the iPhones and eventually buying the most expensive option thinking that they would get more value for the money.”

5. Economy pricing

With economy pricing, you lower the price point of products—without necessarily lowering your margins—by lowering the production cost. The lower quality (perceived or otherwise) of the product is offset in value by the deal customers are getting. Sometimes, a retailer will have a more upscale version of the product available as well.

Grocery stores routinely use economy pricing. Consider one of Canada’s most iconic brands: No Name.

With their generic yellow packaging, low advertising budget and low production cost, No Name is able to offer shoppers more affordable versions of name-brand products. No Name’s parent company, Loblaw Companies Limited, has higher priced store brands along with No Name to emphasize No Name’s monetary value (and the other brands’ potential quality value).

6. Multiple pricing and discount pricing

Multiple pricing and discount pricing occurs when items are priced at a discount if multiples are purchased at one time. Think of buying one pair of socks for $5, two pairs for $8 and so on. Straightforward discount pricing doesn’t need too much explaining. Customers love good old-fashioned discounts and they can be a great way to shift stubborn inventory or late-season items.

7. Penetration pricing

Penetration pricing is another form of discounting—with a twist.

One way to explain it is through the competitive world of video-on-demand streaming services. Think Netflix, Amazon Prime, Hulu and any other streaming services you use at home on a regular basis. Because this market is so competitive, many new entrants will use penetration pricing to attract and hopefully retain new customers.

This involves offering a lower price for an initial period, to hopefully get the customer ‘hooked’ on the service so that they will be willing to pay full price moving forward. As more products move towards subscription pricing, it’s a pricing approach worth considering.

8. Value pricing

Value-based pricing is truly customer-focused pricing, as Investopedia explains. That’s because it is based on how much your customer believes a product is worth. This pricing strategy basically attempts to strike a balance between a product’s cost and its quality.

The reason value pricing can be so effective is because it’s based on something that’s hugely valuable to all businesses: a great understanding of the customer. But it’s not easy to achieve. Value-based pricing isn’t based on guesswork; it’s based on slow and detailed investigation to understand your customers, the products they truly want and what is valuable to them below a surface level.

9. Loss leader pricing for retail

With this pricing strategy, you sell select goods at an unprofitable margin with the aims of bringing in new customers and/or encouraging customers to buy other, more profitable products.

Think about printers—they’re often very affordable, but replacing the ink is expensive. The printer is a loss leader that ensures customers for a profitable product later down the road.

Loss leader pricing is common in restaurants—i.e. menu items that are not profitable, but the difference is made up in alcohol sales. However, in retail, this pricing strategy may be seen as exploitative as it disproportionately hurts small businesses.

10. Competitive pricing

Competitive pricing is the practice of setting prices as a response to your competitor’s products.

Generally, this means pricing goods at or near the competition to attract a similar market value. You may also deliberately price higher than the competition to imply a higher value, or price slightly lower to siphon price-minded customers without giving up too much of the margin.

11. Psychological pricing

As we explained earlier, much of pricing is based on what people think, want and feel. This is why pricing is often hard to untangle from psychology. In many senses, pricing is a form of marketing—and the best marketing draws on psychology in a positive way. There have been hundreds of studies over the years about why consumers buy more goods that are priced at odd numbers, instead of even or round ones. It’s part of our brains’ wiring.

A popular example of psychological pricing is charm pricing. Have you ever wondered why most products are priced as $5.99 instead of $6.00? This is because just the simple difference of lowering it one cent to a price that ends with the number 9 or 99, causes customers to interpret it as having a completely different value and being more attractive.

Ending prices in “.99” is one of the oldest tricks in the pricing playbook. Numerous studies have shown that prices ending in .99 outperform those that end in .00. Why? Because consumers have been conditioned to associate 9-ending prices with bargains or deals.

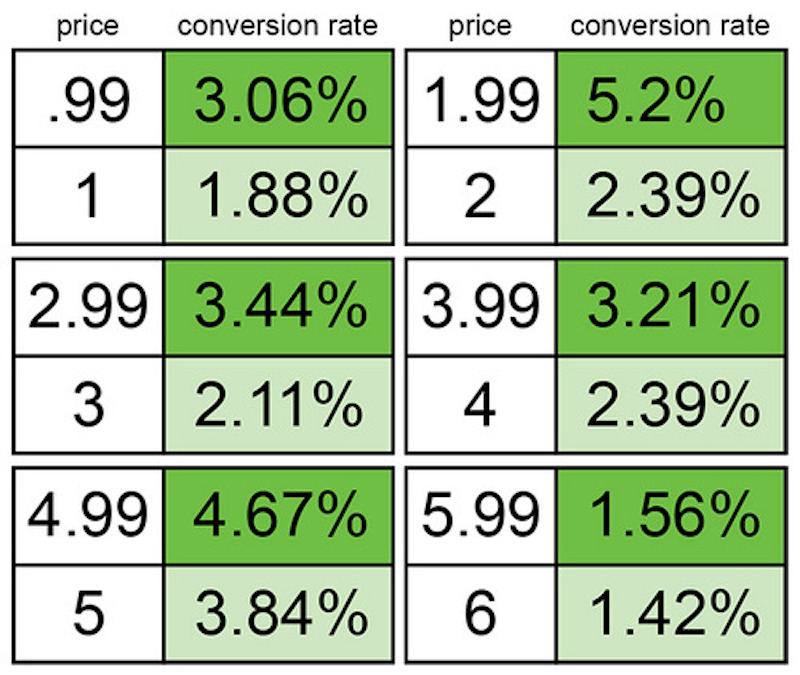

Check out this neat chart by Gumroad, a platform that enables creatives to sell directly to their audience. Gumroad analyzed the purchases made on its site and compared the conversion rates of items in whole dollar prices with those that ended in .99.

As you can see, products with prices ending in .99 outperformed the ones with whole numbers across the board—and in one case, the conversion rate was twice as high.

The reason for this? Consumers experience the “left-digit effect,” which is the brain’s tendency to pay more attention to digits on the left side of the decimal point. What happens is people base their purchase decision on the first digits they see, rather than the price as a whole.

The same thing can be said about prices ending in .97. Most retailers running deals end their sale prices in .99 or .97 to make them more enticing.

So should you start eliminating whole numbers from your price list? Not quite. The left-digit effect may work well when you’re selling to bargain-hunters, but if you’re catering to a high-end or exclusive market, you’re better off using whole numbers.

Research has shown that “there is a perceived relationship between prices ending in 0 and overall quality, and prices ending in 9 and overall value.” In other words, it appears that people associate whole-number prices with higher quality.

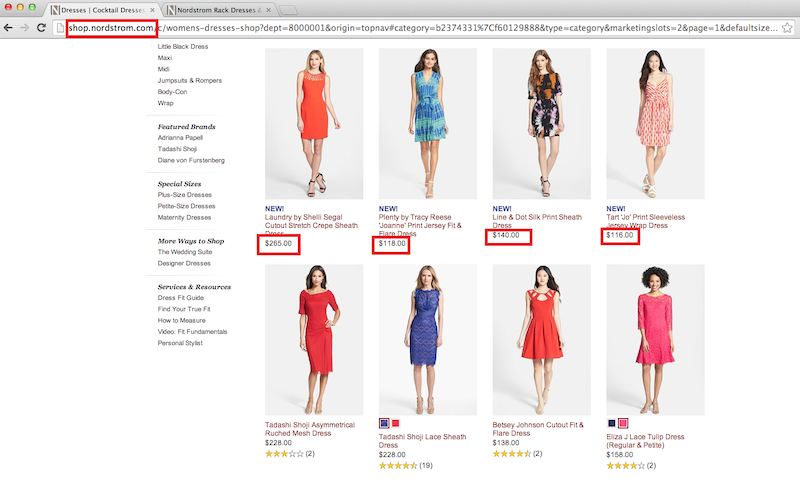

Take a look at the examples below. The top one is a screenshot from upscale department store Nordstrom’s website. Notice something about the prices on the page? Yup, they’re all whole numbers, indicating that the products are for customers willing to spend more.

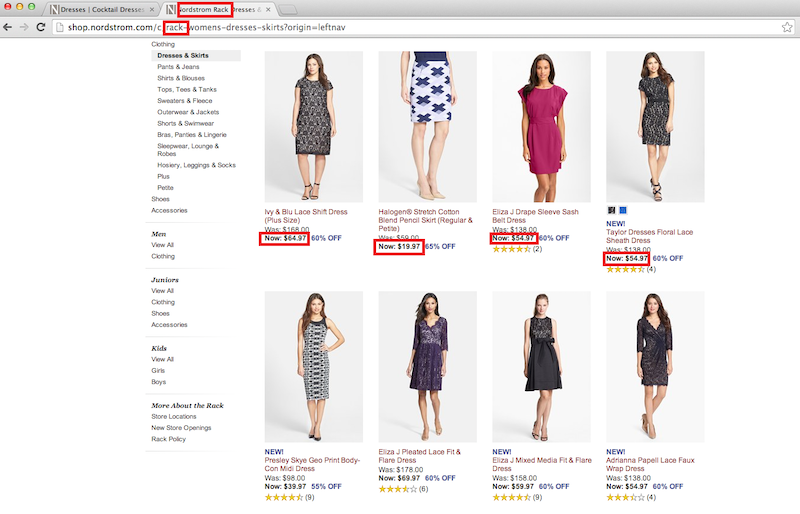

But if you head to Nordstrom Rack, the company’s outlet store that’s known for price cuts and sales, you’ll find that almost all the items are priced at xx.97.

Nordstrom

Nordstrom Rack

The takeaway here is that ending your prices in .99 or .97 won’t automatically attract more customers. You have to consider what it is you’re selling, who you’re selling it to, and the perception you wish to convey.

12. Luxury and premium pricing

Some brands and businesses–think Cartier, or Gucci–price their products to make customers perceive value. Again, psychology is at play. High-end retailers know that customers who buy their products are purchasing a feeling of status, as much as they are purchasing, say, a handbag or a bracelet. Pricing your goods in the highest tiers is effective, only if every aspect of your product, customer experience and loyalty services can match the price tag.

13. Bundle pricing

Bundle pricing can be useful for retailers if you want to package and market your products into an experience for customers.

For example, a deli could bundle crackers, meats, cheeses and wine to suggest customers have a picnic experience. Or a butcher could bundle certain products to suggest a barbecue. With bundle pricing, you offer a range of products that are normally priced individually at one single price.

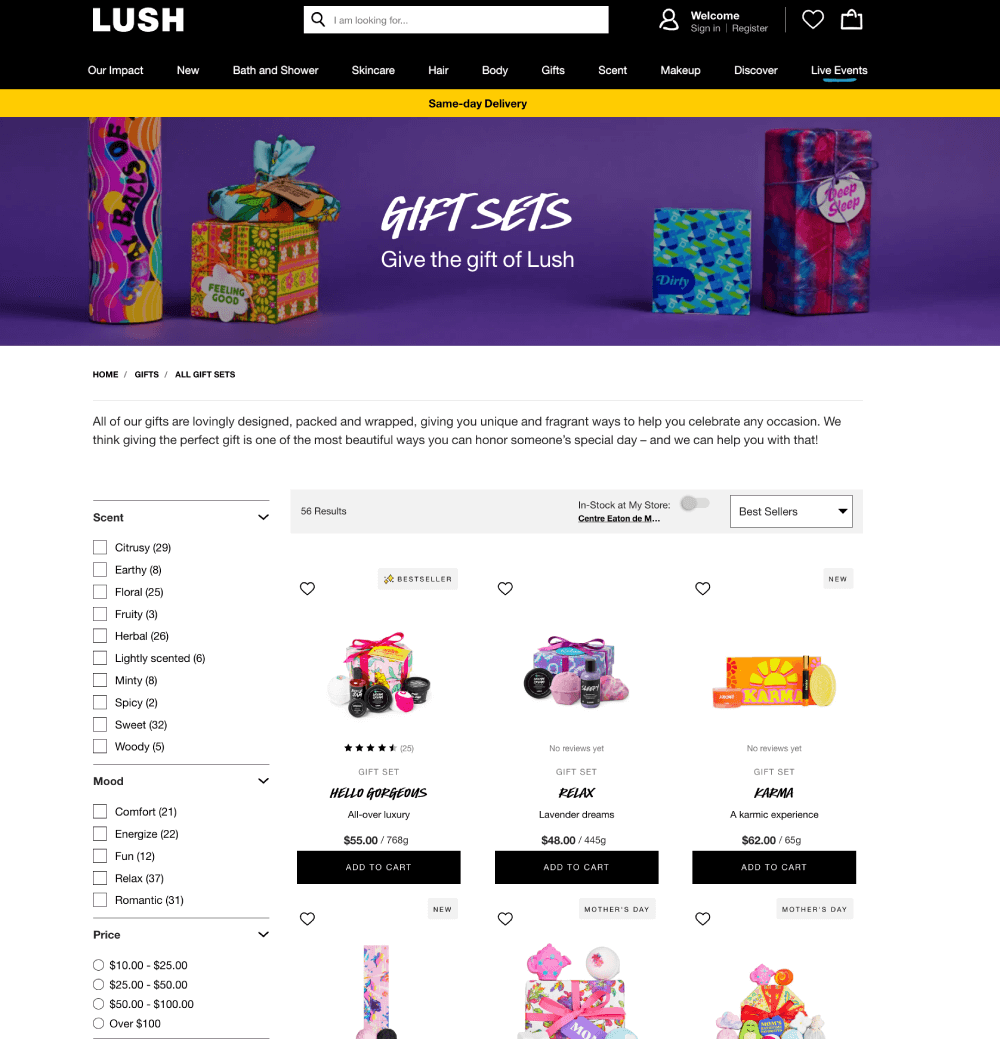

Consider bath and beauty retail giant, Lush, and their bundles. They’re a successful go-to gift for birthdays and holidays because they’re simply priced, smartly curated and attractively presented.

Lush Canada advertises gift bundles separated into categories by scent, mood, price, occasion, recipient and product preference.

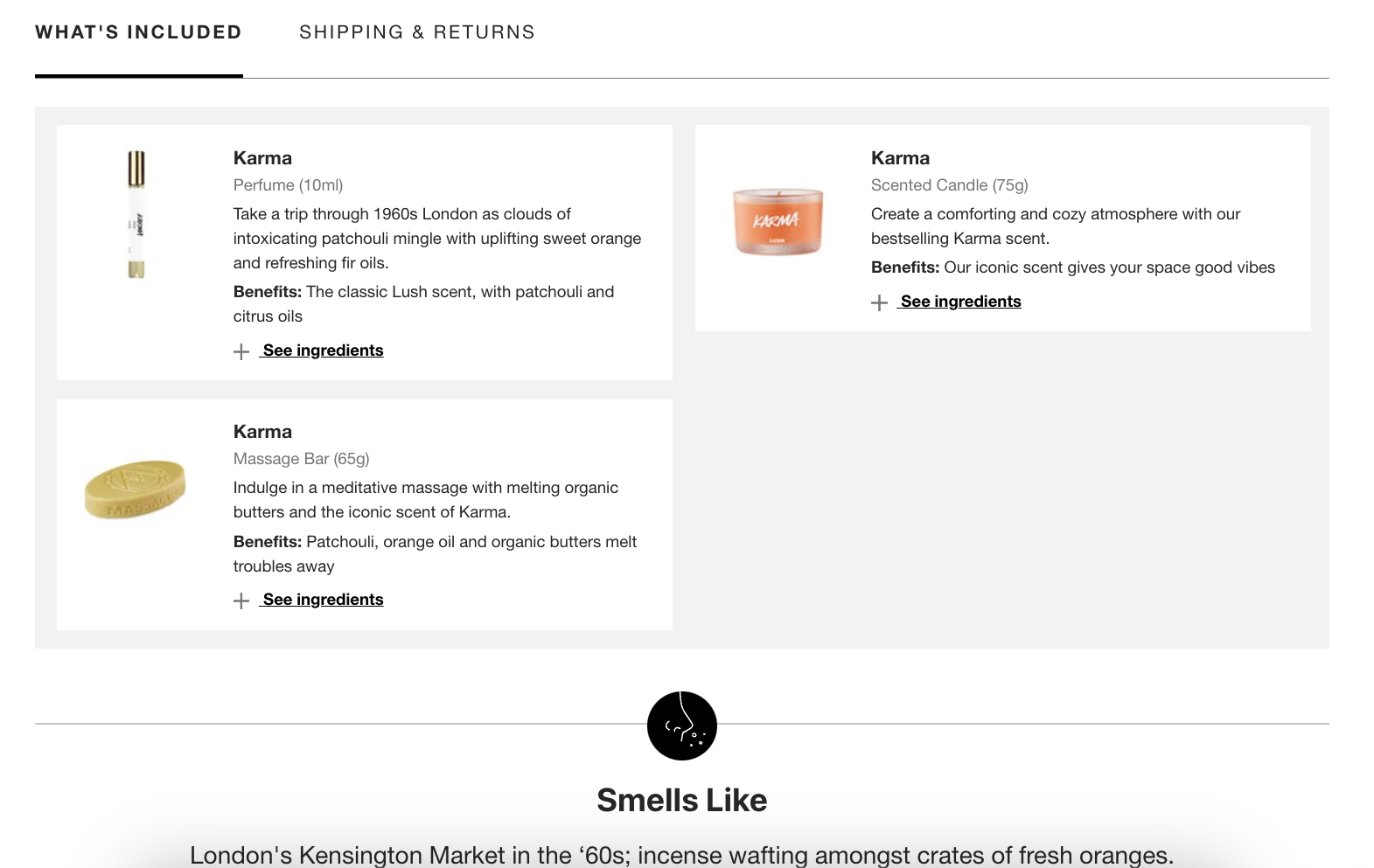

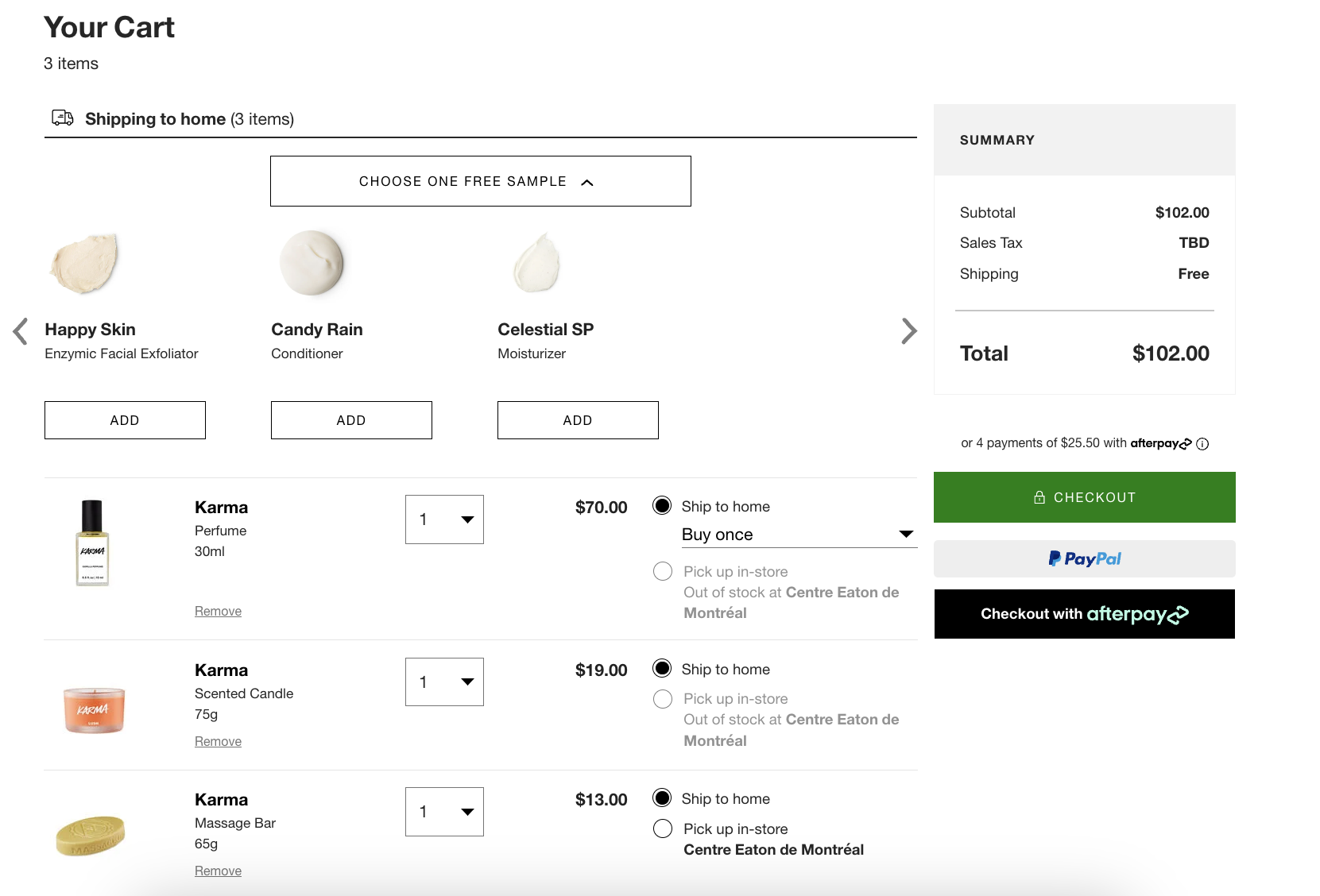

When we open one bundle, Karma, we see three products:

Individually, these products add up to $102 CAD before sales tax. The Karma bundle, featuring a smaller perfume sample than what can be bought individually, costs $62 CAD.

WIth the bundles, customers don’t need to bother with trying to pick out complementary products, and they don’t need to source gift wrapping. They can pick up a box with an applicable theme and be done with it. They can even save money versus buying the products individually (though in a lower quantity). And even though Lush is selling these products for lower than purchasing separately, the volume of gift bundle sales makes up for it.

With some creativity, bundle pricing can help retailers shift inventory that would not be appealing, or would be overlooked or overwhelming, alone.

14. Anchor pricing

With anchor pricing (or price anchoring), you display two prices: the original cost of the product, and the discounted cost. The first cost is the anchor, and it helps customers make purchase decisions based on the second cost.

The most straightforward use case for retail would be sales—show both the normal cost and the current, lower price to instill a sense of urgency in your customers. You can also use this pricing strategy in your store layout by placing similar products with different price points together.

15. Dynamic pricing

Dynamic pricing is the practice of adjusting your prices in real-time in response to market demands, trends, or even the prices of your competitors.

Consider, for example, the dynamic pricing battle between Amazon and Best Buy, which were both selling a GE microwave oven.

According to the WSJ, sellers on Amazon changed the price nine times in one day, with the price fluctuating between $744.46 and $871.49. Best Buy responded by lifting its price on the oven to $899.99 from $809.99, then lowering it again after Amazon prices for the oven dropped.

So how does dynamic pricing work? Retailers typically use algorithms or dynamic pricing platforms that automatically factor in trends and crunch the numbers to determine the best prices to serve up on a website. In some cases, shopper behavior also becomes a factor, and customers see prices based on their likelihood to convert.

For instance, if a store’s marketing or pricing platform determines that a shopper is more likely to convert at a discount, then the retailer might offer a lower price to that customer. Conversely, if the technology determines that a shopper would purchase a product at full price, then they wouldn’t be offered a discount.

Some retailers take a different approach. David Mercer, at Smart Modern Entrepreneurs, says that they monitor sales and price performance of competing products on Amazon using a price tracker tool, and they get alerts about pricing and sales.

According to Mercer, “This helps us monitor the pricing changes… and helps inform decisions on how to price our own products, along with a bunch of other benefits — like knowing when competitors’ products are selling well and being able to work out what marketing they used to drive those sales.”

Note: it’s not for everyone.

Dynamic pricing can be a good way to automate and optimize your retail prices, but exercise caution when implementing this strategy. A survey by Retail Systems Research found that consumers generally aren’t fans of the practice.

In her article on Forbes, Nikki Baird, the managing partner at RSR, shared that “71% of U.S. consumers surveyed didn’t like the practice, and another 23% thought it was merely ‘okay.’” Not surprisingly, the survey also found that millennials are more likely to accept price matching, with 14% indicating that they “love it.”

Bottom line? Consider what you’re selling, the market you’re in, and who your customers are before implementing dynamic pricing.

As Baird notes, “there are use cases where dynamic pricing makes sense – during intensely competitive shopping times, like on Black Friday, or for items with short life spans, like coleslaw at the end of the day. But as far as a general strategy for retail, it appears that consumers don’t appreciate it – and that retailers are getting the message.”

How to lower your prices the right way

While slashing prices certainly attracts customers, executing discounts the wrong way could end up killing your profits or enticing the wrong types of shoppers (i.e. those who’ll only buy from you when you lower your prices.)

That’s why if you’re looking to run sales or discounts at your store, it’s important to plan your promotions well and craft thoughtful offers to meet your objectives. Go through the pointers below for some tips and ideas on how to implement discounts correctly.

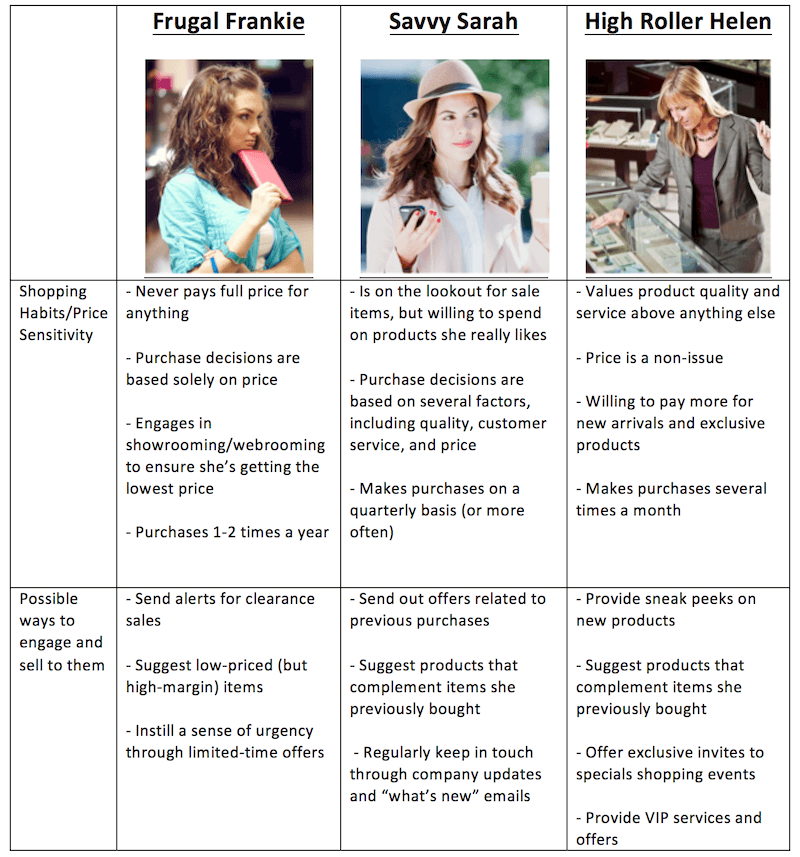

Segment shoppers and tailor your price-cuts accordingly

Creating discounts or offers based on different customers’ preferences or purchase histories can greatly increase conversions. Take the time to segment your customer base so you can market and sell to them accordingly.

One way of doing this is to set up customer profiles. Create profiles outlining the price sensitivity and shopping habits of different customers and use them as tools to determine the kinds of discounts to offer each shopper type.

Below are some sample customer profiles that you can create:

Sending out tailored offers may sound tricky, but it’s actually quite doable if you have the right tools. Make use of a robust customer management system that gives you a history of what shoppers bought from you. That way, you’ll be able to easily see who’s buying what, and how much each customer has spent.

Make sure the timing is right

When it comes to discounts and offers, timing can be just as important as relevance. Sending out deals at just the right time (i.e. when customers need them) will greatly increase your conversion rates.

This is why you also have to pay attention to when shoppers are buying from you. For instance, if you have a lot of customers who buy at the end of the month, then schedule your offers around that time.

Also, remember that the question of when a customer looked at a product or bought something can provide insights into what they might buy next and when. For example, Blue Nile, an online jewelry retailer, times its wedding band emails based on its estimates on when customers got engaged.

See if you can do something similar in your business. Let’s say you sell baby clothing and merchandise, and a customer just bought some clothes for her three-month-old son. Using that data, you might be able to predict what she’ll need in six months or a year, and you can make relevant product recommendations or offers.

Offer discounts to select consumer groups

You can also consider offering exclusive discounts to specific groups of consumers (ex. students, military, senior citizens etc.). According to Marci Hansen, CMO of eligibility verification solution SheerID, this strategy allows retailers to leverage discounts without hurting their margins or being defined as a discount brand.

One company that does this well is The Great Wolf Lodge, a resort and waterpark in North America. Great Wolf has a program called “Howling Heroes,” which exclusively gives an all year 30% discount to military (active, retired and veteran), fire, emergency medical service personnel, 911 dispatchers, police and correctional officers.

“Strategically offering exclusive discounts instead of site-wide price reductions or coupon codes gives retailers more control over their margins and the growth of their core customer base,” said Marci. “By offering special discounts or perks to educators and members of the military community, marketers can attract new, loyal customers without diminishing their overall brand.”

“Existing customers don’t begrudge retailers who offer military, student, or educator discounts, the way that they do if a company offers new customer discounts. In fact, most consumers look favorably upon businesses that honor military service and value education,” she added.

Which retail pricing strategy is right for you?

“In today’s retail environment, retailers have to consider multiple factors in their pricing approach,” says Josh, at Parker Avery Group. “Competitive price positioning, customer response and financial targets all come into play. Also, differences in customer behavior in different geographic markets, as well as price sensitivity by channel (brick and mortar versus an online store) are complicating factors.”

Ultimately, no one pricing tactic will be enough. You’ll likely need to combine the tactics above, and if your retail business is young, you’ll need to experiment. Much will depend on the category of product you sell, too. With a cloud-based point of sale you’ll be able to make pricing adjustments in real-time to different products and test out the best strategy for you.

One thing’s for sure, getting pricing right at the right time can be a gamechanger for retailers.

If you’re interested in learning how Lightspeed Retail POS can help you make real-time price adjustments, let’s talk.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.