![Opening a Retail Store? Here's What you Need To Know [2024 UPDATE]](https://blog-assets.lightspeedhq.com/img/2021/03/eedc4859-blog_opening-a-retail-store_1200x628.jpg)

So, you’re thinking about opening up a retail store? In today’s digital age with same-day eCommerce deliveries, your friends and family may think you’re crazy; but we see genius.

Traditional retail isn’t dying, it’s changing. While economic changes might have shifted our spending patterns and shopping behaviors, some retail stores are actually growing, despite trends and articles that may suggest otherwise.

Selecting the right business structure, writing a detailed plan and picking powerful tools that work together is more important than ever to set your business up for success. We’ll help you do all of those things and more, so that your business can thrive in an ever-changing retail environment.

Meet the new era of commerce

Omnichannel retail puts the customer at the center of the shopping experience, giving them a seamless experience on multiple interconnected channels. Find out how to take your new retail store to the future.

In this guide, we’ll cover the steps you need to take to open a retail store successfully. Specifically, we will touch on the following.

- Research your market

- Define your legal structure

- Pick your business name

- Write a business plan

- Get funding

- Get licensing and permits

- Find your location

- Choose your business tools

- Reach out to suppliers

- Build your online store

- Hire and train staff

- Market your store

- Implement a strong design and visual merchandising strategy

- Have security measures in place

- Don’t forget about legal considerations

Research your market

Before you start writing your business plan, fine-tune your store’s vision and purpose.

There are two kinds of market research you can conduct: primary research, where you find the answers on your own (such as by interviewing local business owners), and secondary research, where you consult public data and records by other parties (such as the U.S Census Bureau or Statistics Canada). When you’re seeking to open a retail store, use both approaches to get a well-rounded view of the market.

Ask yourself the following questions to figure out how you’ll set your business apart from what’s already out there:

- Why do you want to open a retail store in the first place? Are you serving a need or meeting a demand?

- Do you have any data (qualitative or quantitative) that proves this need exists?

- What are your business’s core values?

- Who will your customers be? What are their core values?

- What makes your idea or concept unique? Is there a business similar to yours nearby?

- What will set you apart from your competitors?

Depending on your answers, you may need to adjust your vision, proposed stock or potential location to have the best possible chance of success.

Define your legal structure

| Business structure | Ownership | Liability | Taxation | Formalities and paperwork |

| Sole Proprietorship | Single owner | Unlimited personal liability | Personal income tax | Minimal |

| Partnership | Two or more individuals | Depends on the type of partnership | Partnership income tax return, but income/loss reported on personal tax returns | Moderate, partnership agreement recommended |

| General Partnership (GP) | Two or more individuals | Unlimited personal liability for all partners | Partnership income tax return, but income/loss reported on personal tax returns | Moderate, partnership agreement recommended |

| Limited Partnership (LP) | One or more general partners and one or more limited partners | General partners have unlimited liability, limited partners have limited liability | Partnership income tax return, but income/loss reported on personal tax returns; different rules for general and limited partners | Moderate to high, more complex structure |

| Limited Liability Partnership (LLP) | Two or more partners with limited liability | Limited liability for all partners | Partnership income tax return, but income/loss reported on personal tax returns | Moderate to high, requires registration as an LLP |

| Corporation | One or more shareholders | Limited liability | Corporate tax, potential double taxation | High, subject to state and federal regulations |

| C Corp | One or more shareholders | Limited liability | Corporate tax, potential double taxation, but eligible for special taxation treatment | High, subject to state and federal regulations |

| S Corp | One or more shareholders, with restrictions on the number and type | Limited liability | Pass-through taxation | High, subject to state and federal regulations, with additional IRS requirements |

| Limited Liability Company (LLC) | One or more members | Limited liability | Flexible, can choose between corporate tax or pass-through taxation | Moderate to high, depending on state laws and chosen tax status |

Before you open your doors, you’ll need to decide on a legal structure for your business. Your legal structure will affect how you pay taxes, the amount of personal liability for any debts, your ability to raise capital and have shareholders—all of which have a huge impact on your operations. We’ve laid out all of the different options so you can find the one that works best for you.

Sole proprietorship

A sole proprietorship is the simplest legal structure in terms of taxes and paperwork, but that doesn’t necessarily mean it’s the best choice. Unlike the other business structures, you don’t need to fill out any formal paperwork to form your business. It also means you’ll only need to complete one tax return during tax time.

However, as a sole proprietor, a major downside is that you’re 100% liable and responsible for any debts from your business. If you fail to repay your business debts, your home, savings and other personal assets may be used as collateral.

Partnership

A partnership is a legal agreement between two or more people to be co-owners of the business. Each partner can have varying degrees of vested interest depending on what type of partnership you set up. These are the different types of partnerships you can form:

General Partnership (GP)

With this kind of partnership, each partner participates in day-to-day operations and has control over the business. As co-owners, partners share liability for debts. This partnership works best if both partners want to have a say in the business’s management and operations.

Limited Partnership (LP)

Limited partnerships have a general partner that is responsible for day-to-day activities as well as a partner(s) who is not involved in the daily operations. The most common example of this would be a silent partner, or someone who provides capital for the business but is not involved in daily operations.

Limited Liability Partnership (LLP)

A Limited Liability Partnership (LLP) means two things:

- All partners share a limited amount of personal responsibility for the business.

- All partners can participate in management tasks and operations, if they want to.

This kind of partnership is popular with law firms, accounting firms and other service professionals because it protects each partner from being responsible for the debts of the other partner.

Corporation

Corporations are one of the more complicated business structures to set up and maintain because they involve extensive record keeping, reporting and tax requirements. This also means they cost more to operate. Like partnerships, there are varying degrees or different types of corporations you can form. It’s up to you and your partner(s) to decide which structure makes the most sense, given everyone’s interests.

C Corp

This kind of corporation is a legal entity that remains completely separate from its owner(s). The separate entity allows the corporation to make a profit, record losses, be taxed and held legally liable independently from the owner. The biggest advantage of a C Corp is the protection from personal liability. The greatest disadvantage is taxation, because in some cases, corporations are taxed twice: once upon earning a profit and another when dividends are paid to shareholders.

S Corp

S Corporations are a popular option among retail store owners because they’re hybrids of a corporation and partnership. With an S Corp, profits and losses passed through the personal income tax of its owner(s) or shareholders, just like in a partnership. On the other hand, an S Corp also provides personal liability protection, just like a corporation would.

Limited Liability Company (LLC)

An LLC is a hybrid of a corporation and partnership. From a tax perspective, an LLC is most similar to a partnership. Profits and losses are passed through to the owner’s personal income tax, so there’s no need to file a separate corporate tax return. Limited Liability Companies also enjoy personal liability protection like corporations do.

Another way to think about an LLC is as a more formalized partnership. You’ll need to file official paperwork with your state, but you won’t need to hold annual meetings for directors or shareholders and keep detailed records of those meetings and major business decisions like you would if you were a corporation.

Once you have an idea of the legal structure you want to use, the next step is registering your business. Most of the time, this involves filing paperwork with your state’s Secretary of State Office, a Business Bureau or a Business Agency. This varies state by state, so we recommend checking out the Small Business Administration’s page on registering your business.

Pick your business name

Your business name impacts every aspect of your business, so it’s important to pick one that reflects the brand identity you’re trying to create. Your business name can be anything from straightforward and logical to pun-filled and off-beat. If you’re having trouble coming up with a name, you can use a free business name generator to spark some ideas.

Once you have your business name nailed down, you will want to ensure that it isn’t already trademarked or in use.

We also strongly recommend checking to see if the web domain name and corresponding Facebook, Instagram, Twitter and Pinterest handles are available for your chosen name before registering your business. If available, make sure you claim your future website’s domain name and any matching social media handles immediately. Doing so will ensure that no one else can take them while you’re working on filling out any legal paperwork. It’s best if all of your social media handles are the same across every platform.

Write a business plan

Once you’ve settled on a legal structure, you can start drafting your business plan. Your business plan doesn’t need to be long and complicated, unless you plan to form a C Corp. Most retailers typically set up sole proprietorships, partnerships or one of the hybrid structures where documentation is much easier to put together.

A business plan should act as an outline or roadmap for your business. It details your goals and gives answers as to how you plan to reach them, so that you have a framework in place to help you build and grow your business. Keep in mind that business plans are not set in stone and are meant to be flexible. They should be considered a work-in-progress that you’ll continually shape as your business evolves.

Here’s a list of what to include in your business plan:

Products and services

This is where you’ll write down all your great ideas about why you’re going into business. List the types of products and services you’re going to provide, describe how they will be provided, include vendor and supplier information and detail future areas for expansion.

Target market

In this section, you’ll need to answer these two main questions: 1. Who are your customers? and 2. Why should they buy from you over one of your competitors? Is it price, convenience or high-quality products?

Marketing strategies

Your marketing strategy is where you can get creative and figure out how you’re going to bring in customers and what your brand stands for.

How are you going to get new customers? Are you going to market your business with social media posts, online ads, or blog posts? How are you going to generate press about your store’s opening? Are you going to reach out to local news sites or online publications? Are you going to set up profiles on Google My Business, Yelp and other business search engines?

Pricing, merchandising and future partnership strategies are also areas you want to touch on under the marketing umbrella. For merchandising, you can describe the layout of your store. Are you going to put your items with the highest profit margin by the entrance of the store or are they things that need to be kept in countertop cases?

Future partnerships can include things like partnering with other local businesses or community organizations that complement your business, which would broaden your reach.

Employees and staff

As much as you’ve said to yourself that you can do it all, chances are you’re going to have to hire some employees as you grow.

Describe what your staffing requirements will be by day of the week, peak times throughout the day and any seasonal peaks that may be relevant such as back-to-school or holidays. How are you going to find your employees? Where are you going to post your open job listings? What does your screening and training process look like?

Financial forecast

Last but not least, a business plan needs to include a financial forecast to estimate your revenue and expenses.

The best way to do this is with a pro forma statement. Typically, this is best done using historical data that can easily be pulled from a POS system, to find your sales revenue and Cost of Goods Sold (COGS) on a monthly or yearly basis. You’ll also need to subtract your expenses and operational costs for the same period to determine your actual business performance—and use that to create your pro forma.

If you don’t have any data because you’re a new business, you’ll need to estimate these numbers. You can base them on things like your profit margins and growth from any marketing efforts so far. Don’t forget to subtract your projected start-up cost, which includes operating expenses such as payroll, and rent for retail space.

Get funding

If you want to open a retail store, you’ll need the funds to get it started.

With your business plan written, it’s time to put it to work. You should have projected figures for what you’ll need to acquire inventory, pay rent, hire staff and cover other opening costs. How will you fund them? Are you planning to take out a bank loan? Your business plan will help assure the bank you have a plan for the funds. However, taking on a bank loan yourself is riskier than some alternatives available to you.

Look for government-sponsored loans or grants for more assurance. In the United States, the Small Business Association has a number of funding programs that match businesses with lenders for less risk. In Canada, the Small Business Financing Program helps SMBs loan money while sharing the risk with a government-backed body.

You could also try looking for an angel investor—a high net-worth individual who will typically own part of your business in exchange for funding. While angel investors often expect a high return and can be hard to convince, they can cover a significant amount of the funding your new business needs. Make sure your business plan is airtight, then browse angel investor organizations like Angel Capital Association for potential investors.

Finally, you can approach family and friends for investment, but be careful. Always make sure there are clearly defined contracts—written contracts, not verbal. While you’re doing the best you can to succeed, any business hiccups might strain a personal relationship, so you should lean on family and friends last.

Get licensing and permits

Filing for business permits is probably the least exciting task on this list, but it’s definitely a must. If you open your doors without the proper permits and licenses, you might be charged with a criminal offense or a big fine depending on the laws in your state.

Employer identification number (EIN) or Business number

For U.S. based businesses, an EIN is like a social security number for your business. The good news is it’s super easy to get one; all you need to do is visit the IRS website and apply. You’ll get your EIN as soon as your application is completed. For Canadian businesses, a business number is required.

State and provincial local licenses

Since the federal government, states, provinces, cities and counties have their own requirements for a business license, the best advice we can give you is to check with each agency to determine the proper ones needed for your business. The Small Business Administration (SBA) and the Government of Canada website are great resources for researching federal, state and provincial requirements.

As for city and county agencies, this can either be done online or via a phone call. The Government of Canada has a great online resource that helps you check which licenses are required for your business and province.

One thing to note is that some retailers might not require federal licensing. If you open a clothing boutique, chances are you won’t need a federal license to do so. But if you’re starting a wine shop or a vape shop, you will most definitely need a license from the government to sell such products.

Resale certificate

As a retailer, you are going to buy products from vendors or distributors and then resell them to your customers. A resale certificate allows you to buy these items without paying tax to the seller. Use this interactive map to click on your state to find the right website to apply for your resale certificate.

Seller’s permit

A seller’s permit allows you to sell your products in the state and also recognizes you as an entity that collects sales tax. To get one, you’ll need to visit your state’s department of revenue site.

Certificate of occupancy (CO)

Any brick and mortar stores, or even pop-up shops (depending on local regulations and how long they’re open for) will require a C of O. This ensures that your store’s building is in compliance with building codes and other laws that make it safe for employees and customers to visit. You can get a certificate of occupancy through your local government, such as your town or county’s building department or department of housing.

Find your location

One of the most important parts of opening a retail store is having a place to open your store in.

When looking for your future storefront, try to balance rent costs and potential traffic. A very low rent will mean nothing if you’re out of the way of potential new business, just as a high foot traffic location will be hard to keep open if the rent is too high.

The average small-to-medium store is between 1000 and 5000 square feet. Commercial rent in shopping centers in the most expensive U.S. states averages around $26.84 per square foot. Don’t let that math scare you, though—you have options for lower rent if you open up in a smaller town or opt for a smaller than average store.

Choose your business tools

Once you’ve registered your business and put together a business plan, your next step in starting up is choosing the right tools to make it easy to run and grow your business. Here are some of the major tools you’ll want to account for:

Retail point of sale (POS) system

A modern, cloud-based POS is a must for 2021 and beyond. Not only will this system allow you to process transactions with all major payment types (credit card, debit card, cash, NFC, etc.), but you also get access to advanced reporting, inventory management tools and employee management capabilities that can help you grow sales and run your business more efficiently.

Just ask Wilfredo Rodriguez, CFO at Sunmed (aka Your CBD Store). Thanks to Lightspeed’s POS and retail platform, Your CBD Store has been able to be more efficient with their operations and focus on growth.

“Lightspeed is an investment in helping us build a foundational technology piece that’s helping us grow and generate more revenues,” shares Wilfredo.

He continues, “We wanted a product that was going to be stable and reliable and easy for our franchisees to use. That and working relationship and the support that we’ve received from the Lightspeed team, from the account management all the way through to the onboarding folks and the support folks has been very positive.”

Payment processing

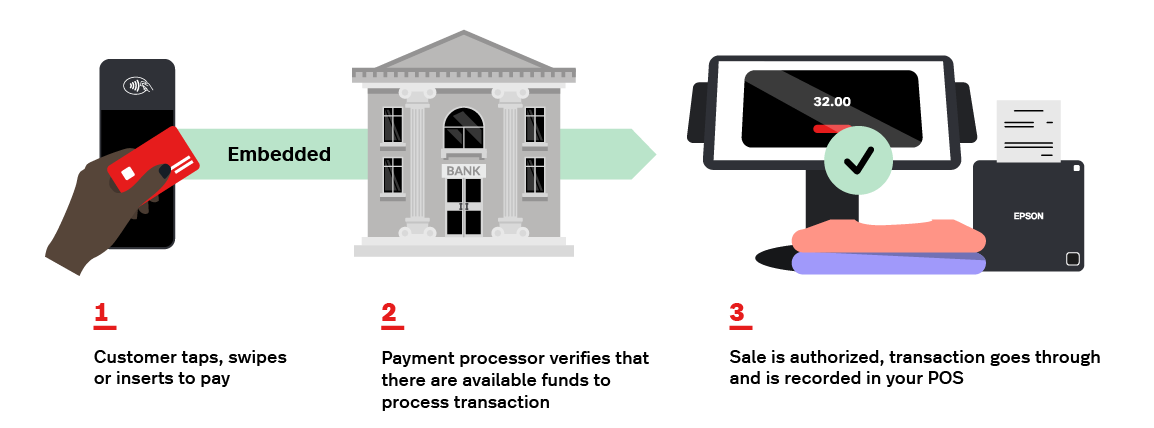

In order to take credit card payments at your register, you’ll need to sign up for a payment processor. Payment processors take a small fee or percentage of each credit card sale, so it’s in your best interest to find a processor that saves you money in the long run. Those small fees add up over time and have a major impact on your business. A low fee, easy-to-use processor that offers fast payouts to your bank account is ideal for any retailer.

Pro tip: For best results, choose an embedded payments solution such as Lightspeed Payments. With embedded payments, you’re not relying on a third party payments provider to process credit card transactions. Your POS system and payments software are natively integrated, resulting in faster checkout processes and more visibility into your payments data.

Consider Lighthouse Immersive, which saw significantly reduced transaction times and increased efficiencies when they switched to Lightspeed Payments.

“Now our transactions, start to finish, [take] less than seven seconds, which is incredible. We’re saving time left, right and center, which I love. I am all about the efficiencies,” says the company’s Global Retail Manager Wendel Wray

Tools for today and beyond

Keep your customers and employees safe by setting your store up with screen guards and contactless, signature-free credit card readers. Signing up for a mobile payments app to take payments whenever and wherever will allow you to take sales beyond your store’s walls. Flexibility is key.

Accounting

Accounting can be one of the most frustrating aspects of running a small business, which is why we recommended signing up for an accounting software platform as soon as possible. To make things as simple as possible, you can select a system that connects with your POS system to allow for streamlined and accurate accounting. When the two are connected, your POS system records your daily transactions and syncs that data with your accounting software automatically, so that all of your numbers are ready to go come tax season.

Reach out to suppliers

As a retailer, you’ll likely be sourcing most, if not all, of your stock from wholesalers.

Making connections with legitimate wholesalers requires a whole guide in and of itself—and luckily, we’ve already got one for you. Check out our advice for buying wholesale here.

Build your online store

In today’s world, online stores are a must.

There are dozens of eCommerce platforms out there, and some are designed specifically for retail businesses looking to sell online. With the definition and experience of eCommerce expanding to include social selling, you’ll want access to features that connect with Facebook, Instagram and TikTok shopping. That way, even if you decide to forgo social commerce for now and focus on your website, you’ll be able to launch extra sales channels without needing to change platforms.

Platforms like Lightspeed’s eCommerce make it easy to build a fully-functional, well-designed online store, even if you’re not tech savvy. By choosing an eCommerce platform that integrates with your point-of-sale register, your inventory will be synced across online and in-store transactions.

Tori Erickson, Founder of the apparel retailer Loyal Tee, appreciates the seamless integration of in-store and online inventory management. That’s why Loyal Tee chose Lightspeed to run their physical and online store.

“With Lightspeed, I’m able to sync our in-store inventory with our online store,” says Tori. “That really helps me reach online consumers. I feel confident that the inventory levels that I and my sales associates see on the POS and that customers see online are accurate. It’s super user-friendly.”

Hire staff

You’re almost ready to open your store! Time to make sure you have enough employees. Even if you’re planning to work on the floor, you’ll need at least one other sales associate so you can take a day or two off every week.

We’ve broken down the average salaries for retail employees here, but to summarize:

- Retail Sales Associate: across the U.S. and Canada, average of USD $11.94 per hour in the U.S. and CAD $14.67 per hour in Canada for 2022. Note that minimum wage is higher than the national average in some jurisdictions.

- Assistant Store Manager: USD $14.17 per hour and CAD $17.21 per hour. Again, note that minimum wage is higher than the national average in some jurisdictions.

- Store Manager: $27 – $41 per hour.

Market your store

You’ve done it: you’ve gone from business plan to business reality. You’ve picked your location, got your inventory, hired your staff and now you’re ready to open your retail store. Time to get the word out so customers know how to find you.

Marketing can be challenging for busy small business owners, but there are a ton of tools and resources to make it easy.

You can use Canva to make high-quality posts for social media, even without any design expertise. We’ve also compiled some more free templates you can use here. This will help you set up good-looking social media accounts that entrigue potential shoppers.

In addition to organic social posts, try fliers, newspaper ads and paid social media advertising. If you’re new to the world of online ads, check out this guide.

Once your new store’s doors are open, make sure you’re staying in contact with customers so they become loyal regulars.

For example, you can use your POS system’s email integration tool to capture customer emails to send special promos directly to your existing customers. Your POS can also help you manage your business’s presence across sites like Facebook, Google and Yelp and streamline your sales efforts across other channels like social media, eBay and Amazon.

Implement a strong design and visual merchandising strategy

Your store’s layout should facilitate an enjoyable shopping experience. You should consider customer flow, product placement, and the overall aesthetic when setting up your space. Make it a point to craft creative displays, thematic decorations, and strategic product placements to highlight new arrivals, promotions, and best-sellers.

Also, pay close attention to your retail analytics. Track sales and product performance closely, and use those insights to inform your merchandising decisions. Let’s say you notice a bunch of slow-moving items and want to drive sales from these SKUs. In this instance, you could choose to give them more exposure by featuring them in your displays.

From there, you can monitor sales to see if positioning these items more prominently increases their sales.

If you’re using Lightspeed, getting these insights is easy. Simply generate a sales summary report and filter the data based on specific parameters—in this case, certain products or SKUs.

Have security measures in place

Retail crime is on the rise. That’s why security must be a key component of starting—and running—a retail business. Implement security measures like surveillance cameras, anti-theft tags, and alarm systems to protect against theft and ensure the safety of both customers and staff.

If you’re doing business online, cybersecurity is vital. Protect customer data and your business from cyber threats by using secure payment gateways, SSL certificates, and regular security audits.

Don’t forget about legal considerations

This is more of a bonus guideline for when your store is up and running.

Stay informed about the legal aspects of running a retail business, including consumer rights, employment laws, and tax obligations.

In addition, you need to ensure your business complies with consumer protection standards. This includes accurate product labeling, fair pricing practices, and adhering to return and warranty policies.

Get ready for opening day with Lightspeed

There’s a lot you’ll need to consider before your store’s grand opening, but doing all of the necessary paperwork, research and planning upfront will better prepare you to manage a successful business.

Opening a retail store isn’t easy, but there are a ton of tools that make it easier. Get your business started with Lightspeed’s full suite of commerce solutions to sell in person, sell online and adapt to what comes next.

FAQs

Is it profitable to open a retail store?

It can be profitable to open a retail store, but profitability depends on various factors such as the store’s niche, location, competition, operating costs, and how well the store meets market demand. Successful retail stores have a clear understanding of their target market, manage inventory and costs effectively, and create a strong marketing strategy to attract and retain customers.

How much does it cost to open a retail store in the US?

The cost to open a retail store in the US can vary significantly based on the size of the store, location, type of products, and level of inventory. Initial costs can include rent or purchase of space, renovations, inventory, equipment, licenses and permits, marketing, and staff salaries. Small boutique stores might start with costs as low as $50,000, while larger operations could require several hundred thousand dollars or more.

What type of store is most profitable?

The profitability of a store can depend on market trends, demand, and niche. Historically, stores with high markup products (like jewelry, technology, and apparel) or those offering unique services (specialty foods, health and wellness products) tend to be more profitable. E-commerce has also become a highly profitable avenue for retail.

How much profit does a retail store make?

The profit margin for retail stores varies by industry. On average, retail profit margins can range from 2% to 20%, depending on the type of products sold and the store’s operating efficiency. Specialty retailers and those with a strong online presence may achieve higher margins.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.